Wednesday, 5 June 2013

Residential Vs Commercial Property

The intention of this post is not really to prove that residential property investment is better than commercial or vice versa, it's rather to provide an independent comparison between the two. Both methods of investment can be highly profitable if carried out sensibly, but both are very different, and as such might suit different types of investor.

Firstly It must be noted that commercial property is inherently more expensive than residential; to build a well diversified commercial property portfolio directly, you would need a few million pounds spare. Luckily smaller investors can still get involved through collective investment schemes/funds such as the F&C commercial property trust, that I have mentioned in recent posts and have some personal exposure to.

Commercial properties can be harder to value due to the uniqueness of the buildings involved. When a residential property is for sale you can generally find out what a similar property sold for recently in the same area, this is not always possible for commercial property, so extra care and professional advice is needed. A good agent can prove invaluable. This issue is obviously avoided by taking the more passive approach and investing in funds, as you will be paying for professional experience via the fund management fees.

Commercial property can be held directly in a pension fund, whereas residential cannot, this benefit could be very significant for investors wishing to capitalize on the generous tax treatment of pension plans.

Letting time-frames vary considerably between commercial and residential. A residential tenancy agreement usually lasts a year, whereas a commercial lease usually lasts 5+ years. The shorter lease agreements on a residential property can lead to larger void periods, thus negatively affecting returns. However, although void periods on commercial property are shorter on aggregate, it can be quite difficult to find new tenants, and in a subdued climate (such as we are currently) rent free periods are sometimes offered as an enticement, which obviously affect net return.

With residential property, the responsibility of repairs and maintenance falls on the landlord. These costs are often overlooked, and can absorb much of the rental income (30% in some cases). With commercial property the tenant is usually responsible, thus saving the landlord time and expense. One exception of this is office blocks, where some tenants do expect periodic upgrades to the premises at the expense of the landlord.

Commercial rents are generally higher than residential. Between the period 2002-2007 commercial rental yields were 50% higher than that of residential property. I would say that this still holds true now with residential yielding about 5% and commercial around 7.5%

On the flip side of the coin, capital growth has been much higher in the residential market, which has led to superior total returns over a prolonged period.

Over the 30 years between 1981 and 2011, residential property has proved the better investment, returning an average total annual growth of 11.2% p.a. Commercial returns were significantly lower at 9.1% p.a.

It could be argued that government policy has given residential property a helping hand over this period. The Thatcher government implemented policies that incentivised home-ownership, and every government since has tried to capitalize on the 'feel good' factor caused by rising house prices. Have these policies been pushed to the brink? Will residential continue to outperform?

What is clear is that commercial property has taken a considerable beating of late. While residential property fell on average about 15-25% during the credit crisis, the commercial property market plummeted 40-50%, and hasn't made much progress since.

There are many reasons for this; the high street is undergoing a structural change as more business is being done on the internet via remote locations. Business rates are also high and making things more difficult for businesses in the current low growth environment. Also there are an increasing amount of people choosing to work from home which obviously decreases demand for commercial floor space.

All these factors paint a bleak picture for commercial, yet because of them we are seeing the lowest asking prices for many years, and double digit rental yields are common place for those willing to dabble in the more risky end of the market place. The contrarian in me thinks that commercial could be the more profitable choice over the next decade or so.

sources: www.hearthstone.co.uk

www.property-guide.reita.org

Monday, 20 May 2013

Sell in May?

Many of you are probably familiar with the stock market adage: ''Sell in May, go away, come back on St Leger day.'' This little ditty illustrates that the period between November and April tends to offer strong equity returns, but during the period May to October, equities tend to stagnate, and you would be better off in a cash fund.

Whilst I'm sure the statistical data that proves this anomaly is kosher, I'm not sure a long term investor should pay much heed to it. By the time I'd sold all my holdings and bought them back again I would have incurred significant trading fees and also lost out on dividend payments.

As it happens I have made a few disposals this month, but I've reinvested the money elsewhere, because it's ''time in the market'', not ''timing the market'' that is the key to successful long term investment.*

Last week I sold my remaining holdings in Barratt and Taylor Wimpey making 172% and 166% profit respectively on the initial purchases prices.

I initially bought into the house building sector because most of the companies were trading at huge discounts to Net Asset Value (NAV). This is no longer the case, plus I also get the feeling that there is a lot of speculative momentum trading going on that has caused the sector to rise so rapidly. Many of the building companies are still nowhere near their pre-crash highs, but I think the investment case is now not as strong, and the sector could be due a sharp pullback if the macroeconomic picture should turn sour.

I have split the proceeds four ways. Three of them are a top up of existing holdings: Imperial Tobacco, Fidelity Special Situations China, and Murray International Trust. The fourth is a new addition and a bit of a deviation from my existing holdings: F&C Commercial Property trust.

I think that commercial property could be a great investment going forward; it's certainly an out of favour sector having bared the brunt of the recession. Property valuations are cheap and yields are relatively high. This particular fund has performed admirably since it's inception 8 years ago, and has made cumulative gains of 19.5% over the last five years despite a huge drop in value in 2008. Its total expense ratio is a reasonable 1% and its dividend yield is 5.8%, which is significantly more than I was getting from the residential house builders. One downside is that it is trading at a 4.4% premium to NAV.

By moving out of the residential house building sector and into less volatile investments that are offering far higher yields, I feel I have taken some risk out of the portfolio and positioned it well for the future.

I am concerned that if/when the US Fed announces an end or a tapering to its QE program, that this could have a negative effect on equities. High yielding shares that have strong dependable revenue streams should provide better protection should such a pullback occur. The investment into China Special Situations being the exception to this strategy, as the yield on that fund is fairly low. However I think that the China fund should outperform the residential housing sector going forward, hence the switch.

*Quote: George Riles, First Vice President and Resident Manager, Merrill Lynch, Albany, GA

Wednesday, 15 May 2013

Buffett on Strategic Asset Allocation

There was a great video on CNBC last week that compliments my last post about Strategic Asset Allocation (SAA) quite nicely.

If you click the link below and scroll to the second video down in the smaller window, you'll see Warren Buffett waxing lyrical about bonds and their relative value.

At one stage Becky Quick mentions that one of her colleagues was advised that he should have a 40% exposure to bonds. It's clear from Warren's response that he doesn't agree with that advice, and thus probably doesn't agree much with SAA either.

Here's the link -

http://www.cnbc.com/id/100709849

Thursday, 25 April 2013

Why Strategic Asset Allocation Is A Flawed Concept

Strategic Asset Allocation (SAA) is the current orthodoxy for portfolio construction. It involves building a portfolio with a set mix of assets based on a client's risk profile and goals.

For example a 'balanced' (medium risk) investor might be given an asset allocation as follows:

10% commodities,

30% equities,

10% property,

45% fixed interest,

5% cash.

As asset prices change given market conditions, the portfolio needs to be re-adjusted in keeping with the client's risk profile and policy objectives.

Whilst I agree that knowing a client's goals and attitude to risk are of crucial importance when dispensing advice, I don't think it good practice to consign a client to a mix of assets based solely on the outcome of this information. The following are reasons this strategy could prove detrimental.

1. This methodology fails to take into account the relative value of one asset class compared to another. For example during the dot com boom in 1999-2000, the FTSE 100 was trading at a PE ratio of 30 (over double today's value), anyone with a modicum of sense could see that equities were grossly overvalued, yet strategic asset allocation would have heavily exposed an 'adventurous' investor to this asset class resulting in subsequent catastrophic destruction of capital. While equities will always be volatile, it can be argued that investing in them when they are cheap (relative to earnings/net assets) is a lot less risky than investing in them when they are expensive.

As with the above example, the risk of any asset class can change with circumstance. For example it could be argued that long dated government bonds (typically a low risk asset) pose a far higher risk now than they did 7 years ago, before bond markets were subjected to QE intervention from central banks.

At a time when bank solvency is in question it might also be argued that the risk involved in holding cash has increased.

2. The re-balancing of a portfolio, to keep it in line with a clients risk profile, may lead to selling at a bad time. A popular piece of investment advice is to cut your losers and let your winners run. SAA is almost the antithesis of this strategy. Also if portfolios are being rebalanced too often, a hefty amount of trading costs will be incurred, thus negatively affecting returns.

3. People's attitude to risk tends to vary over time given their recent experience. For example clients who have just witnessed an extended equity bull market that has significantly increased their wealth are more likely to be more bullish when filling out a risk questionnaire, and if SAA is used they may be left with a high exposure to equities at a time when equities are overvalued.

Conversely if clients have just been subjected to a long period of negative returns during a recessionary period, they may well be more bearish when filling out a risk questionnaire, thus reducing the proportion of equities in their portfolio at a time when equities may represent very good value.

A variation on this approach is Tactical Asset Allocation (TAA), which allows a range for the percentage of capital in each asset class. For example the range for equities in a balanced portfolio might be 25%-35%. This approach allows an adviser some room to incorporate asset class valuation into the asset allocation strategy. The downside to this (and a big plus to SAA) is that many advisers are terrible at timing the market, and TAA brings the danger of human error into the equation.

For example a 'balanced' (medium risk) investor might be given an asset allocation as follows:

10% commodities,

30% equities,

10% property,

45% fixed interest,

5% cash.

As asset prices change given market conditions, the portfolio needs to be re-adjusted in keeping with the client's risk profile and policy objectives.

Whilst I agree that knowing a client's goals and attitude to risk are of crucial importance when dispensing advice, I don't think it good practice to consign a client to a mix of assets based solely on the outcome of this information. The following are reasons this strategy could prove detrimental.

1. This methodology fails to take into account the relative value of one asset class compared to another. For example during the dot com boom in 1999-2000, the FTSE 100 was trading at a PE ratio of 30 (over double today's value), anyone with a modicum of sense could see that equities were grossly overvalued, yet strategic asset allocation would have heavily exposed an 'adventurous' investor to this asset class resulting in subsequent catastrophic destruction of capital. While equities will always be volatile, it can be argued that investing in them when they are cheap (relative to earnings/net assets) is a lot less risky than investing in them when they are expensive.

As with the above example, the risk of any asset class can change with circumstance. For example it could be argued that long dated government bonds (typically a low risk asset) pose a far higher risk now than they did 7 years ago, before bond markets were subjected to QE intervention from central banks.

At a time when bank solvency is in question it might also be argued that the risk involved in holding cash has increased.

2. The re-balancing of a portfolio, to keep it in line with a clients risk profile, may lead to selling at a bad time. A popular piece of investment advice is to cut your losers and let your winners run. SAA is almost the antithesis of this strategy. Also if portfolios are being rebalanced too often, a hefty amount of trading costs will be incurred, thus negatively affecting returns.

3. People's attitude to risk tends to vary over time given their recent experience. For example clients who have just witnessed an extended equity bull market that has significantly increased their wealth are more likely to be more bullish when filling out a risk questionnaire, and if SAA is used they may be left with a high exposure to equities at a time when equities are overvalued.

Conversely if clients have just been subjected to a long period of negative returns during a recessionary period, they may well be more bearish when filling out a risk questionnaire, thus reducing the proportion of equities in their portfolio at a time when equities may represent very good value.

A variation on this approach is Tactical Asset Allocation (TAA), which allows a range for the percentage of capital in each asset class. For example the range for equities in a balanced portfolio might be 25%-35%. This approach allows an adviser some room to incorporate asset class valuation into the asset allocation strategy. The downside to this (and a big plus to SAA) is that many advisers are terrible at timing the market, and TAA brings the danger of human error into the equation.

Monday, 15 April 2013

Gold Price Collapses

As I write this on the 15th April 2013, intraday gold prices are down 9.22% (silver 11.8%). The yellow metal is down 25% from its high of $1800/oz back in October. I've been bearish on gold for quite some time having written a couple of posts on the topic which I will provide links for below.

http://www.mattjbird.com/2012/12/is-gold-good-investment.html

http://www.mattjbird.com/2013/02/bubbles-gold-government-bonds.html

The reasons I gave for my bearishness were as follows.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

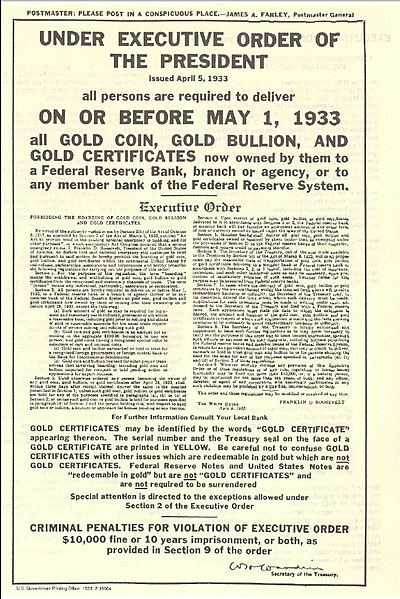

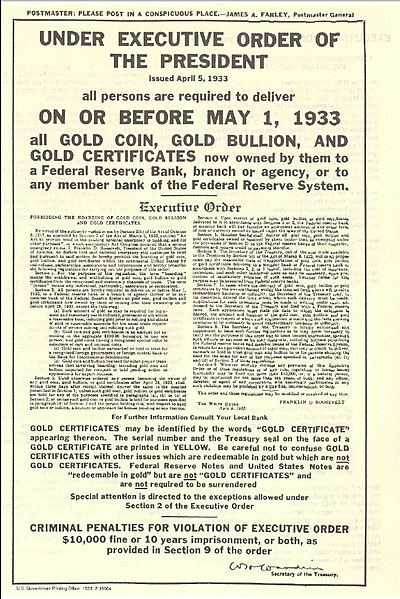

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

In the second link I posted above, I even mentioned trying to profit from the demise of gold via my CFD account (Contract For Difference). Unfortunately I didn't have the conviction to put on the trade, and I still don't. Gold is a highly volatile investment and its value is only based on what the market will pay for it, nothing more. It is possible that this could be a pullback and the Ponzi rally will continue later, I simply don't know and am not willing to risk any money on it.

P.S. I do find it amusing when gold bugs fool themselves that the extraction cost of gold (approx $1100/oz) might be the lowest possible price floor that the metal will reach. They are not taking into consideration the mountains of gold that are stored in the ETF holding facilities across the world. 'Extracting' that gold will cost a LOT less than $1100/oz! Also the demand for gold is highly volatile and has the potential to dry up in an instant, causing massive oversupply. Is the tide going out on this investment? Are you swimming naked?

Friday, 12 April 2013

Making A Mint Out Of Murray (In Investment Trusts I Trust)

A couple of weeks ago I sold my second tranche of house builder's shares, which consisted of half my shareholdings in Barratt and Taylor Wimpey. Having notched up some impressive gains in this sector, I was keen to lock in some of the profit. Both shares were showing gains of around 150% since purchase.

House builders now have only a 5/6% weighting in my portfolio, down from about 20% before the recent bout of sales.

With the proceeds I topped up my holdings a little in AstraZeneca and GlaxoSmithKline, and made a new acquisition in the form of Murray International Investment Trust, which now accounts for 5% of my portfolio. I still hold about 5% in cash.

I like Murray International for several reasons. Firstly the manager's name; Bruce Stout. That's a winners name if ever I heard one. He's also hails from Scotland, a nation renowned for its production of quality managers (Sir Alex Ferguson, David Moyes, Paul Lambert, Malky Mackay).

The fund is a global income fund with a decent yield of 3.4%, notably it also holds some fixed interest holdings, although these currently only account for a very small portion of the portfolio as Bruce shares my bearish views on global bond markets. The fund has performed admirably during his 9 year tenure, boasting impressive returns as shown from the graph below (NB graph is 5Yr). It also picked up a 'Best Global Income Award' from the Investors Chronicle recently.

Unfortunately the fund's huge popularity with investors has resulted in it trading at a significant premium to NAV as shown by the difference between the yellow and blue lines on the graph.

I never like to overpay for anything, but I wanted this fund to be part of my portfolio and I don't see the premium gap narrowing any time soon. I intend to hold this fund long term, and hope in the greater scheme of things, overpaying a little for it will not matter.

For more info on investment trusts check out my old post here.

http://www.mattjbird.com/2012/11/investment-trusts.html

If you're interested check out this link to a video of Bruce Stout explaining his strategy.

http://vimeo.com/29567095

House builders now have only a 5/6% weighting in my portfolio, down from about 20% before the recent bout of sales.

With the proceeds I topped up my holdings a little in AstraZeneca and GlaxoSmithKline, and made a new acquisition in the form of Murray International Investment Trust, which now accounts for 5% of my portfolio. I still hold about 5% in cash.

I like Murray International for several reasons. Firstly the manager's name; Bruce Stout. That's a winners name if ever I heard one. He's also hails from Scotland, a nation renowned for its production of quality managers (Sir Alex Ferguson, David Moyes, Paul Lambert, Malky Mackay).

The fund is a global income fund with a decent yield of 3.4%, notably it also holds some fixed interest holdings, although these currently only account for a very small portion of the portfolio as Bruce shares my bearish views on global bond markets. The fund has performed admirably during his 9 year tenure, boasting impressive returns as shown from the graph below (NB graph is 5Yr). It also picked up a 'Best Global Income Award' from the Investors Chronicle recently.

Unfortunately the fund's huge popularity with investors has resulted in it trading at a significant premium to NAV as shown by the difference between the yellow and blue lines on the graph.

I never like to overpay for anything, but I wanted this fund to be part of my portfolio and I don't see the premium gap narrowing any time soon. I intend to hold this fund long term, and hope in the greater scheme of things, overpaying a little for it will not matter.

For more info on investment trusts check out my old post here.

http://www.mattjbird.com/2012/11/investment-trusts.html

If you're interested check out this link to a video of Bruce Stout explaining his strategy.

http://vimeo.com/29567095

Wednesday, 27 March 2013

Cypriot Implosion & The Budget.

Cracks in the Euro zone experiment have become evident once again, this time centering on the island nation of Cyprus. My shares in Lloyds Banking Group have taken a bit of a nose dive since this news was initially broadcast (about 15% fall), and there will probably be increasing downward pressure if a Cypriot bank run occurs when their banks are finally reopened. If prices are driven low enough I might view this as an opportunity to increase my exposure to the sector.

My views on the Euro zone haven't changed much since my first blog posts on the topic in Jan 2012, check out the links below if you're interested. EU policy makers are being very slow to address the problems they are facing, which is increasing the likelihood of an eventual currency breakup. Personally I think Cyprus would be much better off ditching the Euro in favour of their old currency, which would cause a painful devaluation but make them competitive once again.

http://www.mattjbird.com/2012/01/euro-zone-mess.html

http://www.mattjbird.com/2012/01/to-recap-on-my-last-post-and-add-few.html

The UK Budget was largely unexciting, although the Chancellor did announce policies intended to stimulate growth in the housing sector. One of these was a ''Help To Buy'' scheme directed at first time buyers that will offer up to £3.5bn for shared equity loads towards mortgages. Buyers who put up a 5% deposit can get another 20% from the Govt. The loan will be interest free for the first five years with a ceiling price of £600,000. Also there will be a ''Mortgage Guarantee'' scheme that intends to incentivise lenders to offer people with smaller deposits better mortgages. They will guarantee 20% of the loan on properties worth up to £600,000.

Although I disagree with these meddlesome strategies the Chancellor is employing, I was quite pleased to see that it gave the house builder's shares I own a huge boost. I have now sold my holdings in Telford Homes which have made over 100% profit in a few years and also Persimmon Homes which has made over 150% over a similar time frame.

I still hold shares in Taylor Wimpey and Barratt Developments but will look to offload these as well in due course. At the moment I’m holding the proceeds of the sales in cash.

Monday, 11 March 2013

Aviva Slash Dividend - March Portfolio Update

I've been doing a bit of portfolio spring cleaning this month, have sold Redrow and Aviva. The catalyst for the Aviva sale was a downbeat article in the Sunday Times, turned out to be good timing as they announced a dividend cut a few days later and the share price fell substantially. I suspect this is part of a 'kitchen sinking' operation from their newish CEO to make himself look better over the medium term for 'growing' the dividend once again and returning the company to profit. This is lame, self serving management in my opinion. Anyway I managed to sell at 346p which banked me a nominal capital gain; it's been a decent investment though as I've had 3 years of bumper dividends circa 8%.

I bought Redrow just over two years ago, they were the last house builder I purchased, and the sector had already risen quite a bit by then, but I still made just shy of a 50% profit on them.

I've now split the proceeds two ways. Last Monday I bought some more Fidelity Special Situations China Investment Trust, have about 5% of my portfolio in this now and think it will do well in the long run. It's already up a bit from the 91.5p I paid. With the other half of the money I bought Cairn Energy today at 291p. They were tipped in the Investor's Chronicle a month ago due to their decent discount to NAV. They've had a torrid few years and are out of favour with investors, but have made some changes that should bring some stability to revenue. I'm hoping they will rise on good news over the next few years.

I bought Redrow just over two years ago, they were the last house builder I purchased, and the sector had already risen quite a bit by then, but I still made just shy of a 50% profit on them.

I've now split the proceeds two ways. Last Monday I bought some more Fidelity Special Situations China Investment Trust, have about 5% of my portfolio in this now and think it will do well in the long run. It's already up a bit from the 91.5p I paid. With the other half of the money I bought Cairn Energy today at 291p. They were tipped in the Investor's Chronicle a month ago due to their decent discount to NAV. They've had a torrid few years and are out of favour with investors, but have made some changes that should bring some stability to revenue. I'm hoping they will rise on good news over the next few years.

Wednesday, 6 March 2013

Central Bankers - Clever People?

Below is a link to an old Youtube video of Ben Bernanke. He and his peers (King etc) were blind to the risks of loose monetary policy back in 2005, and it is obvious from his subsequent actions that the penny still hasn't dropped.

Why on earth do we trust these people with our monetary policy? They have no clue. If they worked in private sector banking with Bob Diamond and Fred Goodwin they would have been sacked like dogs long ago.

http://www.youtube.com/watch?v=9QpD64GUoXw

Why on earth do we trust these people with our monetary policy? They have no clue. If they worked in private sector banking with Bob Diamond and Fred Goodwin they would have been sacked like dogs long ago.

http://www.youtube.com/watch?v=9QpD64GUoXw

Monday, 25 February 2013

Muse, Energy & High Speed Train Lines

If you bought the last Muse album 'The 2nd Law' you may have noticed the recurring theme of energy deficiency and the sustainability of our current way of life that runs deeply through most of the tracks.

The title of the album refers to the 2nd law of thermodynamics, which states that 'the entropy of an isolated system never decreases, because isolated systems spontaneously evolve toward thermodynamic equilibrium- the state of maximum entropy. Equivalently, perpetual motion machines of the 2nd kind are impossible.'

This is put into an economic context in the track 'Unsustainable' which says:

''All natural and technological processes proceed in such a way that the availability of the remaining energy decreases. In all energy exchanges, if no energy enters or leaves an isolated system, the entropy of that system increases. Energy continuously flows from being concentrated to being dispersed, spread out, wasted, and useless. New energy cannot be created and high-grade energy is being destroyed. An economy based on endless growth is unsustainable.''

The main flaw in this argument is calling the global economy an isolated system. We receive a certain amount of energy from the sun and other renewable sources that is potentially unlimited (on our time frame anyway) also some technological processes/progression may lead to great reductions in energy demand and may also (nuclear fission?) solve many of our long term energy problems.

The trouble at present is that these renewable sources account for an incredibly small percentage of the total energy used, and most energy consumed is still derived from the burning of fossil fuels, which are becoming increasingly scarce, difficult to source, and expensive.

The world struggles to feed 7bn people under current conditions. How will we fare decades down the line when oil is in much shorter supply, and probably vastly more expensive than it is now?

New oil drilling techniques such as fracking may provide us with a temporary respite, but in the end we will consume these supplies as well (probably at an ever increasing rate) and be left with renewables alone. Will we be able to run our agricultural and manufacturing industries on solar power and other renewables? It certainly wouldn't be possible at the moment.

Tullett Prebon recently published a report called 'Perfect Storm'. In this paper they describe the global economy as a surplus energy equation, i.e. the more energy/resources left over after providing the essentials of life (food/water/shelter) the higher the potential GDP can be. They argue that the massive GDP growth we have seen over the past 200 years has been made possible because of access to cheap and abundant energy, mainly from fossil fuels. They argue this point fantastically well with graphs/diagrams etc and I recommend reading their explanation. The report is 84 pages long but they only really start talking about the energy side of things on page 59 so I advise you start reading there. Here is the link.

http://www.tullettprebon.com/Documents/strategyinsights/TPSI_009_Perfect_Storm_009.pdf

Economists in the UK are currently scratching their heads about why our employment levels have increased dramatically since nadir of the credit crunch, yet GDP levels remain stagnant. A continuing lack of credit will not be helping this, but also I wonder if we might have reached a tipping point in terms of our surplus energy equation? Is it possible to grow in the face of rapidly rising oil prices?

One thing is for certain, countries with the best energy policies going forward will be the most competitive on the global scene in the future. Sourcing cheap reliable energy should be the corner stone of UK government policy. With this in mind I find the latest idea of squandering billions on a high speed train line (HS2) preposterous.

Friday, 22 February 2013

T. Boone Pickens - The Future of USA Manufacturing is Bright

Great 5 minute video on CNBC yesterday where T. Boone Pickens is asked about his thoughts on energy prices and US manufacturing. Check it out.

http://www.cnbc.com/id/100479643

http://www.cnbc.com/id/100479643

Thursday, 21 February 2013

Bubbles - Gold & Government Bonds?

I've written before on a few occasions that I'm quite bearish long term on gold and gov't bonds. In case you missed that check out these links.

http://www.mattjbird.com/2012/12/is-gold-good-investment.html

http://www.mattjbird.com/2012/02/investment-horizons.html

To briefly sum up the situation; Western governments have pushed bond markets to 300 yr highs by pumping them full of QE money. Investors fearing that this strategy will cause hyper inflation and lead to currency collapse have fled into 'safe haven' assets such as gold etc thus also driving the price of these assets into orbit as well.

At some stage the QE policy will have to be reversed or at least abstained, thus sending bond prices through the floor. Also if/when the current debt/Eurozone crisis blows over and a shred of optimism returns, the price of gold will be spiralling the same way.

It would be nice to be able to profit from short selling these assets when they finally give. I have a CFD (Contract For Difference) trading account that enables me to bet on prices falling, it is a risky strategy, and more akin to day trading than investment. Furthermore because CFDs are essentially leveraged it's quite easy to lose more than your initial stake if you get it wrong. The main issue is timing. Gold has fallen 13% since October's highs around the 1800 level. Could this be the start of the collapse or just a temporary pullback? I'm not really willing to bet either way just yet, better to miss the boat than get on it at the wrong time.

I am however keeping a close eye on these markets and may make a move when I think the time is right.

Friday, 8 February 2013

Market Update - February 2013

January brought with it some bumper stock market gains. The FTSE100 rose by 6.4% which is the best performance for this month since 1989. Will the old adage - 'As goes January, so goes the year.' prove correct for 2013? Fingers crossed!

My personal portfolio has performed very well. Leading the pack has been my sector bet on the house builders (Barratt/TaylorWimpey/Persimmon/Redrow/TelfordHomes), which have more than doubled now since purchase. The reason I bought these holdings was that they were all trading at a significant discount to Net Asset Value (NAV). With the exception of Barratt this is no longer the case so I'm starting to think about a possible exit strategy from these companies should they rise much higher.

Lloyds Banking group have also risen quite a bit over the last few months, they are making good progress repairing their balance sheet and deleveraging to meet the new banking criteria. I'm confident that once the PPI mess has blown over that this company will return to a healthy profitable situation and drag the share price up at the same time.

My last purchase back in September of Fidelity's Special Situations China fund has done very well, rising from 75p to around 95p, a gain of almost 30% in under 5 months. I may add to this position soon if the price remains below 100p.

My other holdings have generally risen with the tide, apart from BG Group which has been suffering quite a bit from various set backs (down about 10% from purchase price) and a few others like Vodafone, Astra Zeneca and Polo Resources that seem content to tread water for the time being.

Notably Tesco are making a decent recovery after taking a bit of a hammering early in January last year.

Thursday, 3 January 2013

The UK Stock Market Almanac 2013

If you're interested in stock market related stuff and in need of a diary for the new year you should definitely get yourselves one of these. It's crammed full of data, some useful, some not, all quite interesting. Loads of popular trading strategies in there with statistical results to back them up.

Happy New Year!! - Outlook 2013?

Happy new year everyone! Many thanks for reading and hope you all enjoyed this blog in 2012? I've certainly enjoyed writing it. Just checked my stats and it's had 2487 hits in its first year of operation, with the last few months averaging 400/month, so thankfully I haven't just been writing to myself :)

If anyone wants to get in touch to discuss any of the topics mentioned, feel free to contact me on twitter or matthew.bird@seer-green.com . Constructive feedback/debating welcomed.

Looking back at 2012 after quite an eventful year the FTSE100 gained about 6/7% ish. I can't remember where my portfolio was exactly this time last year but beer mat calculations say I've more than doubled that figure albeit with dividends reinvested. I will start taking better records from now on for improved accuracy. Fingers crossed for similar out performance in 2013.

So looking ahead, what do I think the market will do this year? When asked a similar question the legendary capitalist J.P.Morgan replied - 'It will fluctuate.'

I will not pretend to know any better than him; all we can do is look at the facts and position ourselves accordingly.

The P/E ratio of the FTSE100 is around 11.5, still fairly cheap compared to a long run average of about 14/15, and if you look more closely at individual companies I think there is some fantasic value there at these prices.

There are many factors that could cause an upset this year. Global fiscal tightening is almost bound to carry on as nations struggle to overcome their chronic debt problems. I'm expecting the USA to adopt a more conservative approach which is fairly typical in a post election year. Notably the US markets have a history of underperformance in the years following elections. The UK usually tracks the US quite closely so this might have some effect on us.

Energy prices will continue to play a huge part in things. If oil prices push higher this will choke global growth and make progress increasingly difficult. If it falls however this would have a great positive effect on business. This is very hard to judge, will be interesting to see if new drilling techniques such as fracking etc can make the West less dependent on oil from the Middle East.

Casting doubt aside we do appear to be in a bull market, and I'll certainly be sticking with stocks this year, due as much to lack of alternative choice as any other reason. My 'Investment Horizons' blog post from last February is still mostly pertinent and I hope still worth a read. For anyone that hasn't yet here's the link.

http://www.mattjbird.com/2012/02/investment-horizons.html

Wishing you all the best with your investments and otherwise in 2013,

Matt.

Wednesday, 26 December 2012

US National Debt

Another good link I found on Terry Smith's blog page.

The motivational speaker Tony Robbins ‘deconstructing’ the (debt) situation:

http://www.youtube.com/watch?v=jboTeS9Okak

(20 minute video)

The motivational speaker Tony Robbins ‘deconstructing’ the (debt) situation:

http://www.youtube.com/watch?v=jboTeS9Okak

(20 minute video)

Monday, 24 December 2012

Is Gold A Good Investment?

If you take a moment to scan the daily business pages, or perhaps flick your TV over to Bloomberg or CNBC, there is a good chance you will find some news about the price of gold. It is very much an en vogue investment at the moment; helped no doubt by it's incredible performance over the past 11 years or so as shown by the graph below.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Wednesday, 5 December 2012

Hayek VS Keynes - Terry Smith Blog Post

This is a great blog post from Terry Smith's page, it pretty much sums up my views on the matter of Keynes VS Hayek (Austerity vs Spending).

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

Why people prefer Keynesian policies

I recently read this excellent article by John Phelan, a Contributing Editor for The Commentator and a Fellow at the Cobden Centre, who draws some poignant comparisons between the economic theories of Keynes and Hayek. Phelan makes his point well by describing a debate which took place in the letters to The Times in October 1932 between John Maynard Keynes and Friedrich von Hayek.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

Faced with this the Estonian government embarked on an austerity programme. A real one, not the sort of sham programme which the Chancellor has given us so far in which spending continues to rise but at a lower rate than originally forecast.

In Estonia public spending was cut by 10 per cent between 2008 and 2010. The state’s share of payments to pensions was frozen and its payments to health insurance costs were cut by 8 per cent. Taxes were also increased. In particular VAT was raised from 18 per cent to 20 per cent.As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

Friday, 30 November 2012

Mark Carney - Next Bank Of England Governor

Earlier this week it was announced that Canadian born Mark Carney is due to take the helm at the Bank of England When Mervyn King steps down at the end of June next year. He is the first non-Briton to be appointed to the role since the bank was established in 1694. As well as taking on King's role at the bank he will be given extra

responsibilities as the bank's remit is expanding to include

responsibility for regulation.

Carney has a solid CV, he worked for Goldman Sachs for thirteen years with high level experience in various departments, including sovereign risk and emerging debt capital markets. Through Goldman he was also involved in work on the Russian financial crisis in 1998.

He also has 9 years experience working for the Canadian department of finance and the Bank of Canada (Governor 2008- present) and is the current chairman of the G20's Financial Stability Board.

In short this man is no stranger to tackling debt issues.

He is well respected for his work at the Bank of Canada, and it is notable that the Canadians have emerged from the financial crisis in arguably better shape than the UK.

Personally I will be glad to see the back of Mervyn King, as you will see from previous blog posts I've written such as...

The Global Debt Crisis - Whose Fault? (Jan2012)

http://www.mattjbird.com/2012/01/global-debt-crisis-whose-fault.html

UK Residential Housing, The MPC & Interest Rates (Aug2012)

http://www.mattjbird.com/2012/08/uk-residential-housing-mpc-interest.html

Western Debt Junkies (Aug2012)

http://www.mattjbird.com/2012/08/western-debt-junkies.html

I think he has done a poor job at the bank, and that a big portion of the blame for our current situation should fall on his shoulders for excessively loose monetary policy during the boom years.

Interestingly I was talking to David (Danny) Blanchflower (Ex MPC member, and more importantly Cardiff City fan) yesterday via twitter and I asked him how he rated King's tenure at the bank. 3 out of 10 was the answer, because he ''Missed recession and double dip, (was) taken by surprise by bank failure and slayed dissenters.''

By his ''slaying dissenters'' remark he means (I think) getting rid of MPC members who don't agree with him, thus defeating the whole object of there being a voting system in place.

The press articles I've read thus far seem to paint Mr Carney as having a more hawkish outlook (advocate of higher interest rates) than King, hopefully this means an end to the QE madness that is ruining our bond markets. That would be a great start. Returning to monetary normality however wont be an easy task without upsetting our fragile economy.

I wish him the best of luck for all our sakes.

Carney has a solid CV, he worked for Goldman Sachs for thirteen years with high level experience in various departments, including sovereign risk and emerging debt capital markets. Through Goldman he was also involved in work on the Russian financial crisis in 1998.

He also has 9 years experience working for the Canadian department of finance and the Bank of Canada (Governor 2008- present) and is the current chairman of the G20's Financial Stability Board.

In short this man is no stranger to tackling debt issues.

He is well respected for his work at the Bank of Canada, and it is notable that the Canadians have emerged from the financial crisis in arguably better shape than the UK.

Personally I will be glad to see the back of Mervyn King, as you will see from previous blog posts I've written such as...

The Global Debt Crisis - Whose Fault? (Jan2012)

http://www.mattjbird.com/2012/01/global-debt-crisis-whose-fault.html

UK Residential Housing, The MPC & Interest Rates (Aug2012)

http://www.mattjbird.com/2012/08/uk-residential-housing-mpc-interest.html

Western Debt Junkies (Aug2012)

http://www.mattjbird.com/2012/08/western-debt-junkies.html

I think he has done a poor job at the bank, and that a big portion of the blame for our current situation should fall on his shoulders for excessively loose monetary policy during the boom years.

Interestingly I was talking to David (Danny) Blanchflower (Ex MPC member, and more importantly Cardiff City fan) yesterday via twitter and I asked him how he rated King's tenure at the bank. 3 out of 10 was the answer, because he ''Missed recession and double dip, (was) taken by surprise by bank failure and slayed dissenters.''

By his ''slaying dissenters'' remark he means (I think) getting rid of MPC members who don't agree with him, thus defeating the whole object of there being a voting system in place.

The press articles I've read thus far seem to paint Mr Carney as having a more hawkish outlook (advocate of higher interest rates) than King, hopefully this means an end to the QE madness that is ruining our bond markets. That would be a great start. Returning to monetary normality however wont be an easy task without upsetting our fragile economy.

I wish him the best of luck for all our sakes.

Wednesday, 28 November 2012

Investment Trusts

There have been quite a few articles in the UK financial press lately about Investment trusts. These are closed ended funds that are traded on the stock exchange as public limited companies.

Investment Trusts do not rebate commission to third parties, so at the moment are generally ignored by financial advisors during the advice giving process. The reason for their recent press popularity is that rebating commission is effectively being banned from January 1st with the advent of new RDR (Retail Distribution Review) rules in the finance industry. Theoretically this should lead to higher sales of this particular product as there is no longer any reason for de-selection by advisors.

I've been a fan of Investment trusts for quite a while. They have many advantages over other types of funds such as Unit Trusts and OEICs but also a few disadvantages.

From a fund manager's point of view they are very flexible compared to other investment vehicles. They are allowed to invest up to 15% in any one company as opposed to a maximum of 10% for a Unit Trust or an OEIC, this allows the fund manager to have a much more focused approach. If he likes a particular company or sector he can give it larger weight in the portfolio with greater ease. Also Investment Trusts are allowed to borrow money to gear their portfolio, a useful tool when managers believe share prices are cheap, thus compounding profits (or possibly losses).

This added flexibility means that the ability of the fund manager will have a bigger impact on the fund, which is great if the fund manager is good at his job. Not so good news though if the fund manager is poor, (remember most fund managers underperform the market!). Therefore it is vital to look for a manager with a good long term record of out performance.

As an added bonus, Investment trusts have generally lower fees than Unit Trusts and OEICs, placing them somewhere in between these and tracker funds on the fee scale.

There is one notable downside. As Investment trusts are companies that are floated on the stock market, their share price moves independently of the net asset value (NAV) of the fund. This means that they often trade at a surplus or discount to NAV depending on market sentiment, however it can be argued that this factor could be seen as an upside to the discerning investor looking to snap up a good quality fund at a discount.

To sum it up, Investment Trusts almost certainly carry more risk due to their more flexible nature, but in my opinion that extra risk is worth it in the correct hands. If Carlsberg made investment vehicles.....

Investment Trusts do not rebate commission to third parties, so at the moment are generally ignored by financial advisors during the advice giving process. The reason for their recent press popularity is that rebating commission is effectively being banned from January 1st with the advent of new RDR (Retail Distribution Review) rules in the finance industry. Theoretically this should lead to higher sales of this particular product as there is no longer any reason for de-selection by advisors.

I've been a fan of Investment trusts for quite a while. They have many advantages over other types of funds such as Unit Trusts and OEICs but also a few disadvantages.

From a fund manager's point of view they are very flexible compared to other investment vehicles. They are allowed to invest up to 15% in any one company as opposed to a maximum of 10% for a Unit Trust or an OEIC, this allows the fund manager to have a much more focused approach. If he likes a particular company or sector he can give it larger weight in the portfolio with greater ease. Also Investment Trusts are allowed to borrow money to gear their portfolio, a useful tool when managers believe share prices are cheap, thus compounding profits (or possibly losses).

This added flexibility means that the ability of the fund manager will have a bigger impact on the fund, which is great if the fund manager is good at his job. Not so good news though if the fund manager is poor, (remember most fund managers underperform the market!). Therefore it is vital to look for a manager with a good long term record of out performance.

As an added bonus, Investment trusts have generally lower fees than Unit Trusts and OEICs, placing them somewhere in between these and tracker funds on the fee scale.

There is one notable downside. As Investment trusts are companies that are floated on the stock market, their share price moves independently of the net asset value (NAV) of the fund. This means that they often trade at a surplus or discount to NAV depending on market sentiment, however it can be argued that this factor could be seen as an upside to the discerning investor looking to snap up a good quality fund at a discount.

To sum it up, Investment Trusts almost certainly carry more risk due to their more flexible nature, but in my opinion that extra risk is worth it in the correct hands. If Carlsberg made investment vehicles.....

Subscribe to:

Posts (Atom)