Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

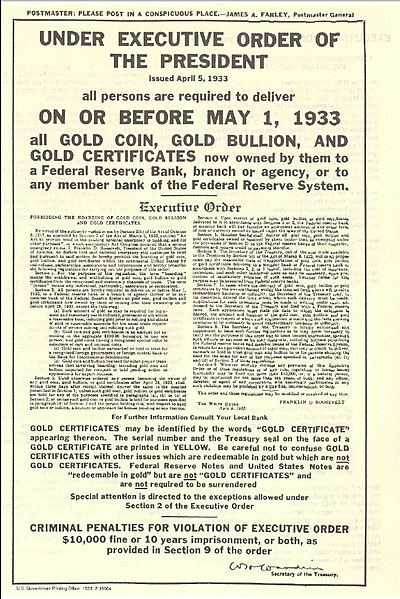

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

No comments:

Post a Comment