Another good link I found on Terry Smith's blog page.

The motivational speaker Tony Robbins ‘deconstructing’ the (debt) situation:

http://www.youtube.com/watch?v=jboTeS9Okak

(20 minute video)

Wednesday, 26 December 2012

Monday, 24 December 2012

Is Gold A Good Investment?

If you take a moment to scan the daily business pages, or perhaps flick your TV over to Bloomberg or CNBC, there is a good chance you will find some news about the price of gold. It is very much an en vogue investment at the moment; helped no doubt by it's incredible performance over the past 11 years or so as shown by the graph below.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

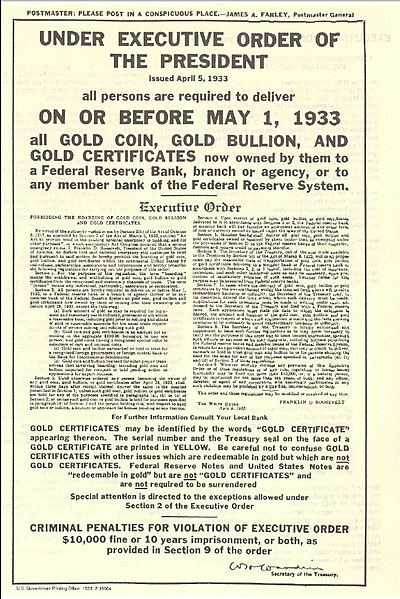

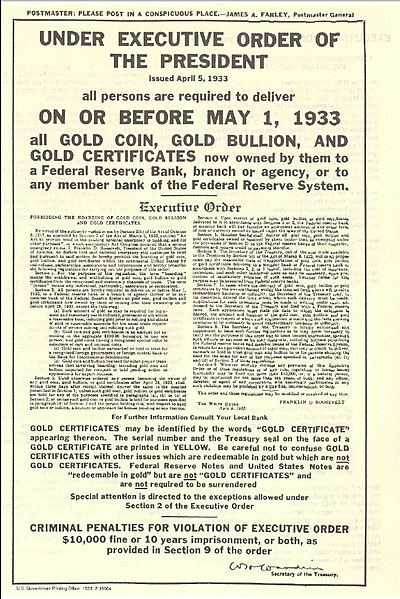

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Wednesday, 5 December 2012

Hayek VS Keynes - Terry Smith Blog Post

This is a great blog post from Terry Smith's page, it pretty much sums up my views on the matter of Keynes VS Hayek (Austerity vs Spending).

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

Why people prefer Keynesian policies

I recently read this excellent article by John Phelan, a Contributing Editor for The Commentator and a Fellow at the Cobden Centre, who draws some poignant comparisons between the economic theories of Keynes and Hayek. Phelan makes his point well by describing a debate which took place in the letters to The Times in October 1932 between John Maynard Keynes and Friedrich von Hayek.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

Faced with this the Estonian government embarked on an austerity programme. A real one, not the sort of sham programme which the Chancellor has given us so far in which spending continues to rise but at a lower rate than originally forecast.

In Estonia public spending was cut by 10 per cent between 2008 and 2010. The state’s share of payments to pensions was frozen and its payments to health insurance costs were cut by 8 per cent. Taxes were also increased. In particular VAT was raised from 18 per cent to 20 per cent.As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

Friday, 30 November 2012

Mark Carney - Next Bank Of England Governor

Earlier this week it was announced that Canadian born Mark Carney is due to take the helm at the Bank of England When Mervyn King steps down at the end of June next year. He is the first non-Briton to be appointed to the role since the bank was established in 1694. As well as taking on King's role at the bank he will be given extra

responsibilities as the bank's remit is expanding to include

responsibility for regulation.

Carney has a solid CV, he worked for Goldman Sachs for thirteen years with high level experience in various departments, including sovereign risk and emerging debt capital markets. Through Goldman he was also involved in work on the Russian financial crisis in 1998.

He also has 9 years experience working for the Canadian department of finance and the Bank of Canada (Governor 2008- present) and is the current chairman of the G20's Financial Stability Board.

In short this man is no stranger to tackling debt issues.

He is well respected for his work at the Bank of Canada, and it is notable that the Canadians have emerged from the financial crisis in arguably better shape than the UK.

Personally I will be glad to see the back of Mervyn King, as you will see from previous blog posts I've written such as...

The Global Debt Crisis - Whose Fault? (Jan2012)

http://www.mattjbird.com/2012/01/global-debt-crisis-whose-fault.html

UK Residential Housing, The MPC & Interest Rates (Aug2012)

http://www.mattjbird.com/2012/08/uk-residential-housing-mpc-interest.html

Western Debt Junkies (Aug2012)

http://www.mattjbird.com/2012/08/western-debt-junkies.html

I think he has done a poor job at the bank, and that a big portion of the blame for our current situation should fall on his shoulders for excessively loose monetary policy during the boom years.

Interestingly I was talking to David (Danny) Blanchflower (Ex MPC member, and more importantly Cardiff City fan) yesterday via twitter and I asked him how he rated King's tenure at the bank. 3 out of 10 was the answer, because he ''Missed recession and double dip, (was) taken by surprise by bank failure and slayed dissenters.''

By his ''slaying dissenters'' remark he means (I think) getting rid of MPC members who don't agree with him, thus defeating the whole object of there being a voting system in place.

The press articles I've read thus far seem to paint Mr Carney as having a more hawkish outlook (advocate of higher interest rates) than King, hopefully this means an end to the QE madness that is ruining our bond markets. That would be a great start. Returning to monetary normality however wont be an easy task without upsetting our fragile economy.

I wish him the best of luck for all our sakes.

Carney has a solid CV, he worked for Goldman Sachs for thirteen years with high level experience in various departments, including sovereign risk and emerging debt capital markets. Through Goldman he was also involved in work on the Russian financial crisis in 1998.

He also has 9 years experience working for the Canadian department of finance and the Bank of Canada (Governor 2008- present) and is the current chairman of the G20's Financial Stability Board.

In short this man is no stranger to tackling debt issues.

He is well respected for his work at the Bank of Canada, and it is notable that the Canadians have emerged from the financial crisis in arguably better shape than the UK.

Personally I will be glad to see the back of Mervyn King, as you will see from previous blog posts I've written such as...

The Global Debt Crisis - Whose Fault? (Jan2012)

http://www.mattjbird.com/2012/01/global-debt-crisis-whose-fault.html

UK Residential Housing, The MPC & Interest Rates (Aug2012)

http://www.mattjbird.com/2012/08/uk-residential-housing-mpc-interest.html

Western Debt Junkies (Aug2012)

http://www.mattjbird.com/2012/08/western-debt-junkies.html

I think he has done a poor job at the bank, and that a big portion of the blame for our current situation should fall on his shoulders for excessively loose monetary policy during the boom years.

Interestingly I was talking to David (Danny) Blanchflower (Ex MPC member, and more importantly Cardiff City fan) yesterday via twitter and I asked him how he rated King's tenure at the bank. 3 out of 10 was the answer, because he ''Missed recession and double dip, (was) taken by surprise by bank failure and slayed dissenters.''

By his ''slaying dissenters'' remark he means (I think) getting rid of MPC members who don't agree with him, thus defeating the whole object of there being a voting system in place.

The press articles I've read thus far seem to paint Mr Carney as having a more hawkish outlook (advocate of higher interest rates) than King, hopefully this means an end to the QE madness that is ruining our bond markets. That would be a great start. Returning to monetary normality however wont be an easy task without upsetting our fragile economy.

I wish him the best of luck for all our sakes.

Wednesday, 28 November 2012

Investment Trusts

There have been quite a few articles in the UK financial press lately about Investment trusts. These are closed ended funds that are traded on the stock exchange as public limited companies.

Investment Trusts do not rebate commission to third parties, so at the moment are generally ignored by financial advisors during the advice giving process. The reason for their recent press popularity is that rebating commission is effectively being banned from January 1st with the advent of new RDR (Retail Distribution Review) rules in the finance industry. Theoretically this should lead to higher sales of this particular product as there is no longer any reason for de-selection by advisors.

I've been a fan of Investment trusts for quite a while. They have many advantages over other types of funds such as Unit Trusts and OEICs but also a few disadvantages.

From a fund manager's point of view they are very flexible compared to other investment vehicles. They are allowed to invest up to 15% in any one company as opposed to a maximum of 10% for a Unit Trust or an OEIC, this allows the fund manager to have a much more focused approach. If he likes a particular company or sector he can give it larger weight in the portfolio with greater ease. Also Investment Trusts are allowed to borrow money to gear their portfolio, a useful tool when managers believe share prices are cheap, thus compounding profits (or possibly losses).

This added flexibility means that the ability of the fund manager will have a bigger impact on the fund, which is great if the fund manager is good at his job. Not so good news though if the fund manager is poor, (remember most fund managers underperform the market!). Therefore it is vital to look for a manager with a good long term record of out performance.

As an added bonus, Investment trusts have generally lower fees than Unit Trusts and OEICs, placing them somewhere in between these and tracker funds on the fee scale.

There is one notable downside. As Investment trusts are companies that are floated on the stock market, their share price moves independently of the net asset value (NAV) of the fund. This means that they often trade at a surplus or discount to NAV depending on market sentiment, however it can be argued that this factor could be seen as an upside to the discerning investor looking to snap up a good quality fund at a discount.

To sum it up, Investment Trusts almost certainly carry more risk due to their more flexible nature, but in my opinion that extra risk is worth it in the correct hands. If Carlsberg made investment vehicles.....

Investment Trusts do not rebate commission to third parties, so at the moment are generally ignored by financial advisors during the advice giving process. The reason for their recent press popularity is that rebating commission is effectively being banned from January 1st with the advent of new RDR (Retail Distribution Review) rules in the finance industry. Theoretically this should lead to higher sales of this particular product as there is no longer any reason for de-selection by advisors.

I've been a fan of Investment trusts for quite a while. They have many advantages over other types of funds such as Unit Trusts and OEICs but also a few disadvantages.

From a fund manager's point of view they are very flexible compared to other investment vehicles. They are allowed to invest up to 15% in any one company as opposed to a maximum of 10% for a Unit Trust or an OEIC, this allows the fund manager to have a much more focused approach. If he likes a particular company or sector he can give it larger weight in the portfolio with greater ease. Also Investment Trusts are allowed to borrow money to gear their portfolio, a useful tool when managers believe share prices are cheap, thus compounding profits (or possibly losses).

This added flexibility means that the ability of the fund manager will have a bigger impact on the fund, which is great if the fund manager is good at his job. Not so good news though if the fund manager is poor, (remember most fund managers underperform the market!). Therefore it is vital to look for a manager with a good long term record of out performance.

As an added bonus, Investment trusts have generally lower fees than Unit Trusts and OEICs, placing them somewhere in between these and tracker funds on the fee scale.

There is one notable downside. As Investment trusts are companies that are floated on the stock market, their share price moves independently of the net asset value (NAV) of the fund. This means that they often trade at a surplus or discount to NAV depending on market sentiment, however it can be argued that this factor could be seen as an upside to the discerning investor looking to snap up a good quality fund at a discount.

To sum it up, Investment Trusts almost certainly carry more risk due to their more flexible nature, but in my opinion that extra risk is worth it in the correct hands. If Carlsberg made investment vehicles.....

Friday, 26 October 2012

Investors Chronicle Comments

As stated in my last post, I thought the comments received from the guys at the Investors Chronicle were largely positive, and I'm very grateful for their input. They did pose a few interesting questions concerning my strategy, and I hope I can answer them sensibly here.

Firstly I'll list the points Chris Dillow makes, and try to answer them in turn.

Q. Why are you so attracted to defensives? There's a bad reason and a good one. The bad one is that defensives are 'safe'. But they are not. Take BAT, your biggest holding, and one of the most defensive stocks on the market..... (he goes on to talk about volatility and says if you want real safety you should be in cash).

A. I disagree with his statement that Defensives are not 'safe'. They are volatile of course, but as Warren Buffet says 'In the short run, the market is a voting machine. In the long run, it's a weighing machine.' The share price of BAT (his case in point) may fluctuate wildly with the rest of the market in the short run, this is in part because the prevalence of index trackers means that the market moves in lock step as the computer controlled funds are forced to sell across the board when people pull their money out forcing all shares down regardless of underlying value.

However, the underlying business in BAT's case is rock solid; they generate massive amounts of cash and are selling a product with a very inelastic demand curve which means they are well placed to pass on any inflationary effects incurred to the consumers of their product. They are also expanding into emerging markets which is more than offsetting the decline in smoking in the West. Their long term share price graph says it all really.

Furthermore I disagree with the notion that being in cash would be any safer. In an environment where inflation is running higher than the average return in a cash ISA I think cash would be a very destructive place to hold your money, especially for a young(ish) investor like me who has plenty of time to ride out any short/mid term dips in equities.

The good reason he talked about was that defensive shares are - 'very often under priced. Investors' pursuit of exciting shares means they ignore dull ones, giving these above-average returns to those smart enough to buy them.'

This is a good point that I totally agree with. While studying for my degree in Economics we covered the subject of the 'favourite-long shot bias', which is where bettors /investors tend to overvalue long shots (tech firms, knee deep in debt and making no money) and undervalue favourites (tobacco firms etc). The topic we were studying at the time was horse racing odds but I think this theory equally applies to the equity markets and many other similar situations where human psychology is involved in betting on outcomes.

Q. There are two things that worry me about your approach. One is that you say you'll trim your tobacco holdings if they rise more....... the old advice to 'run your winners is good'. My second concern is your preference for good dividends (goes on to say some dividends are high for good reasons etc)

A. I do agree with both these points. As a rule I do let my winners run. However if one company or sector grows so much that it is dominating your portfolio, the portfolio is then subjected to more company/sector specific risk. So it's a balancing act really, and as a loose rule I don't want any one company or sector to represent more than 25%-30% of my portfolio. This gives the tobacco firms some way to run before I would start to sell.

The second point is also a good one, you have to be sceptical about why a company's yield is high. When I look for defensive companies to invest in I like to see a good history of steadily growing dividends and also good dividend cover ( the ratio of company's net income over the dividend paid to shareholders ). This generally sorts the good from the chaff.

Helel Miah says that now I have matched the liability on my mortgage I should aim to preserve my capital and structure my portfolio so that it doesn't suffer too much should market conditions turn sour.... 'The best option may be to pay off the mortgage.'

This is sound advice and would certainly achieve my initial objective, however as a relatively young investor with a long mortgage term, I think the best option is to remain invested in equities. I have considered however paying my mortgage down a bit so that I have 40% equity in the property and can benefit from better mortgage deals. If I were to do this the ROCE (return on capital employed) would be about 6% which I think is very attractive in the current environment.

A few people have asked me what performance I've achieved over the last 7 years. I've invested approximately 60k so have effectively almost doubled my money over the timeframe. This includes dividends being re-invested. It is hard to calculate an annualised gain as I've been drip feeding money in randomly, as and when I could afford to. But I think I've easily averaged over 10% a year which is quite pleasing in a market which has barely moved over the period.

Thursday, 25 October 2012

Investors Chronicle Article

Was chuffed to bits last week to have an article about my portfolio published in the Investors Chronicle, a publication over 150 years old that I would recommend to anyone with more than a passing interest in investing.

The comments were positive in the main I thought, although a few questions were asked concerning my strategy, which I will answer/explain in my next blog post.

Will attach the link to their site below and also copy the text underneath as i'm not sure how long that page will stay live.

www.investorschronicle.co.uk/2012/10/11/your-money/portfolio-clinic/playing-it-too-safe-CxCvzHyzHC3wLMZc3zOTOM/article.html

Is our 32-year-old reader wrong to be attracted to defensive stocks?

Matthew Bird's portfolio

Source: Investors Chronicle. Price and value as at 03 October 2012.

Chris Dillow, Investors Chronicle's economist, says:

This is a well-diversified portfolio. Sixty per cent of it is in defensives - telecoms are like utilities these days - with most of the rest in high-beta stocks such as builders and Lloyds. Your one genuinely speculative holding, Polo Resources, is too small a proportion of your portfolio to matter much.

This poses the question: why are you so attracted to defensives? There's a bad reason and a good one.

The bad one is that defensives are 'safe'. But they are not. Take BAT, your biggest holding, and one of the most defensive stocks on the market. Its volatility since January 2000 is such that there is almost a one-in-five chance of it falling 10 per cent over a 12-month period, even if you think (optimistically) that its average returns will be 10 per cent a year. And its correlation with the All-Share index implies that, if the market falls, BAT will probably fall, too. It is a defensive stock not because it is safe, but because it is less likely to lose a lot of money than other stocks, and more likely to fall less if the market falls. But losing money slowly is not a virtue.

If it's a safe asset you want, you must hold cash, not defensives. Risk aversion is no case for holding defensives.

Instead, the case for them is that they are very often underpriced. Investors' pursuit of exciting shares means they ignore dull ones, giving these above-average returns to those smart enough to buy them. The reason for holding defensives is that you think this process is still happening.

One sign of how well-diversified you are is that you only have the one bank. For me, this is good. Banking stocks tend to be highly correlated with each other, all falling or all rising together - although, of course, to (slightly) different degrees. In this sense, holding more than one bank stock would be pretty redundant. Yes, stock-specific risk matters in banks. But sector-specific risk matters more. If fears of another financial crisis fade, banks will do well, and Lloyds will very probably gain.

There are, though, two things that worry me about your investing approach. One is that you say you'll trim your tobacco holdings if they rise more. For the tobacco sector, this is no bad thing, because there tends not to be momentum in large defensives. However, as a general approach to investing, it is a problem. Trimming your winners risks denying yourself the profits that can be made from momentum. The old advice to 'run your winners' is good.

My second concern is your preference for good dividends. On this point, economic theory and common sense agree - you don't get owt for nowt. A good yield is, in theory, only compensation for poor growth prospects (such as tobacco and utilities) or especial risk. And recent history vindicates theory. High-yield stocks were clobbered by the 2008 crisis - remember, Northern Rock and Bradford & Bingley were high yielders - and have recovered only a little since then. This warns us that the old idea that a high yield is a sign that a share is cheap can be dangerously mistaken. Lots of things are cheap for good reasons.

By all means, regard a high yield as a clue that a share might be underpriced. But a clue is not the same as proof.

Helal Miah, investment research analyst at The Share Centre, says:

You have achieved your goal to match your liability on the interest-only mortgage. You should now aim to preserve your capital and structure your portfolio so that it doesn't suffer too much should market conditions turn sour. Consider when your interest mortgage is due for repayment in full. If it matures within the next 10 years, then we would question whether being invested fully in equities is wise.

Plenty of time is required for equities to ride out cyclical downturns and major market corrections. Let's not forget that the FTSE 100 is still below its highs of nearly 12 years ago, around the peak of the dot.com bubble. Maybe more use could be made of safer government bonds; however, in the current climate it is likely that you will pay more in interest charges than you will receive in bond yields. The best option may be to pay off your mortgage.

However, assuming that the mortgage maturity is for a longer period, then equities should be the key focus to generate additional returns.

In terms of the portfolio allocation, the first thing to notice is the large weighting towards the pharmaceutical and tobacco sectors of roughly 20 per cent each. These are defensive sectors that should both provide a degree of safety and also good dividend yields. The tobacco stocks have benefited hugely from emerging markets consumers, while the pharmaceuticals have struggled to generate much capital growth. However, they do partly compensate with dividends, AstraZeneca and GlaxoSmithKline will provide yields of roughly 6 and 5 per cent respectively, while British American Tobacco and Imperial Tobacco will provide dividend yields in the region of 4 per cent. We do like the way you have split up your exposure to the sector by investing in a couple of companies.

We consider the above stocks along with Tesco and Vodafone, which can in some ways be considered utility stocks, as your core holdings, generating high yields with defensive characteristics.

We agree that Lloyds could end up being one of your most lucrative investments, but this goes hand in hand with it being one of your more risky stocks. We are still uncomfortable with banking stocks as the macro environment is still uncertain with plenty of scope for some as yet unknown scandal to pop up again in the sector.

We would consider your 16 per cent exposure to homebuilding companies a little overweight; however, we understand the reasons for your bullishness towards the sector. The sector has been receiving boosts in the form of central banks' attempts to keep interest rates low to get the housing market going and acknowledgment by the government that we are short of roughly 100,000 homes in the UK. The sector will also benefit from infrastructure spending that has been touted to get the economy going. Spreading it out among several names is certainly a good way to play it.

Apart from the exposure to the housebuilders, we would say that the portfolio largely does match your attitude to risk. The majority of the portfolio is weighted towards the large-cap 'core holdings', proving the income and a degree of stability, with smaller holdings in riskier 'satellite' stocks providing stronger growth potential.

The portfolio as a whole has a yield of 3.4 per cent, slightly below that of the FTSE All-Share, and a beta of 0.96, meaning that your portfolio should be slightly less volatile than the market as whole.

The comments were positive in the main I thought, although a few questions were asked concerning my strategy, which I will answer/explain in my next blog post.

Will attach the link to their site below and also copy the text underneath as i'm not sure how long that page will stay live.

www.investorschronicle.co.uk/2012/10/11/your-money/portfolio-clinic/playing-it-too-safe-CxCvzHyzHC3wLMZc3zOTOM/article.html

Playing it too safe?

By Chris Dillow

,

12 October 2012

Reader portfolio

- Name Matthew Bird

- Age 32 , Risk-averse share portfolio

- Objectives Pay off mortgage

Matthew

Bird is 32 and has been investing seriously since 2005. He initially

started investing to pay off an interest-only mortgage of £105,000.

After seven years he has achieved this goal but will continue to invest

as long as he sees value in the market.

"Usually,

I like to buy safe, well-known, large-cap companies with good dividends

and the possibility of moderate growth. However, some of the portfolio

is quite speculative - ie, banking, insurance and builders. I am still

positive about all of my holdings. I think in years to come Lloyds

Banking may prove to be the most lucrative investment but am wary of

over-exposing myself to one company.

"The yields

from insurers are very attractive, so maybe a top-up of Aviva or

possibly Admiral could be next. I'm a bit disappointed with the

performance of my Tesco and AstraZeneca shares, but both look great

value so I might increase those, too. The tobacco sector has done very

well lately - if it goes up much further I may trim my holdings a little

so I'm not over-exposed there."

| Name of share | Ticker | Number of shares held | Price | Value |

| AstraZeneca | AZN | 361 | 2,904.5p | £10,485 |

| Aviva | AV. | 1,038 | 326.8p | £3,392 |

| BAE Systems | BA. | 1,683 | 334p | £5,621 |

| Barratt Developments | BDEV | 2,894 | 175p | £5,064 |

| BG | BG. | 376 | 1,303.5p | £4,901 |

| British American Tobacco | BATS | 409 | 3,248.16p | £13,285 |

| BT | BT.A | 1,395 | 232.1p | £3,237 |

| GlaxoSmithKline | GSK | 776 | 1,449p | £11,244 |

| Imperial Tobacco | IMT | 309 | 2,313p | £7,147 |

| Lloyds Banking | LLOY | 32,761 | 39.01p | £12,780 |

| Persimmon | PSN | 247 | 753p | £1,860 |

| Polo Resources | POL | 55,217 | 2.95p | £1,629 |

| Redrow | RDW | 3,314 | 159p | £5,269 |

| Telford Homes | TEF | 1,953 | 133p | £2,597 |

| Tesco | TSCO | 2,536 | 331.25p | £8,400 |

| Taylor Wimpey | TW. | 5,043 | 54.65p | £2,756 |

| Vodafone | VOD | 3,946 | 177.2p | £6,992 |

| Total | £106,659 |

| Last three trades: Lloyds - Buy at 28p Lloyds - Buy at 22.5p Polo Resources - Buy at 2.8p |

Chris Dillow, Investors Chronicle's economist, says:

This is a well-diversified portfolio. Sixty per cent of it is in defensives - telecoms are like utilities these days - with most of the rest in high-beta stocks such as builders and Lloyds. Your one genuinely speculative holding, Polo Resources, is too small a proportion of your portfolio to matter much.

This poses the question: why are you so attracted to defensives? There's a bad reason and a good one.

The bad one is that defensives are 'safe'. But they are not. Take BAT, your biggest holding, and one of the most defensive stocks on the market. Its volatility since January 2000 is such that there is almost a one-in-five chance of it falling 10 per cent over a 12-month period, even if you think (optimistically) that its average returns will be 10 per cent a year. And its correlation with the All-Share index implies that, if the market falls, BAT will probably fall, too. It is a defensive stock not because it is safe, but because it is less likely to lose a lot of money than other stocks, and more likely to fall less if the market falls. But losing money slowly is not a virtue.

If it's a safe asset you want, you must hold cash, not defensives. Risk aversion is no case for holding defensives.

Instead, the case for them is that they are very often underpriced. Investors' pursuit of exciting shares means they ignore dull ones, giving these above-average returns to those smart enough to buy them. The reason for holding defensives is that you think this process is still happening.

One sign of how well-diversified you are is that you only have the one bank. For me, this is good. Banking stocks tend to be highly correlated with each other, all falling or all rising together - although, of course, to (slightly) different degrees. In this sense, holding more than one bank stock would be pretty redundant. Yes, stock-specific risk matters in banks. But sector-specific risk matters more. If fears of another financial crisis fade, banks will do well, and Lloyds will very probably gain.

There are, though, two things that worry me about your investing approach. One is that you say you'll trim your tobacco holdings if they rise more. For the tobacco sector, this is no bad thing, because there tends not to be momentum in large defensives. However, as a general approach to investing, it is a problem. Trimming your winners risks denying yourself the profits that can be made from momentum. The old advice to 'run your winners' is good.

My second concern is your preference for good dividends. On this point, economic theory and common sense agree - you don't get owt for nowt. A good yield is, in theory, only compensation for poor growth prospects (such as tobacco and utilities) or especial risk. And recent history vindicates theory. High-yield stocks were clobbered by the 2008 crisis - remember, Northern Rock and Bradford & Bingley were high yielders - and have recovered only a little since then. This warns us that the old idea that a high yield is a sign that a share is cheap can be dangerously mistaken. Lots of things are cheap for good reasons.

By all means, regard a high yield as a clue that a share might be underpriced. But a clue is not the same as proof.

Helal Miah, investment research analyst at The Share Centre, says:

You have achieved your goal to match your liability on the interest-only mortgage. You should now aim to preserve your capital and structure your portfolio so that it doesn't suffer too much should market conditions turn sour. Consider when your interest mortgage is due for repayment in full. If it matures within the next 10 years, then we would question whether being invested fully in equities is wise.

Plenty of time is required for equities to ride out cyclical downturns and major market corrections. Let's not forget that the FTSE 100 is still below its highs of nearly 12 years ago, around the peak of the dot.com bubble. Maybe more use could be made of safer government bonds; however, in the current climate it is likely that you will pay more in interest charges than you will receive in bond yields. The best option may be to pay off your mortgage.

However, assuming that the mortgage maturity is for a longer period, then equities should be the key focus to generate additional returns.

In terms of the portfolio allocation, the first thing to notice is the large weighting towards the pharmaceutical and tobacco sectors of roughly 20 per cent each. These are defensive sectors that should both provide a degree of safety and also good dividend yields. The tobacco stocks have benefited hugely from emerging markets consumers, while the pharmaceuticals have struggled to generate much capital growth. However, they do partly compensate with dividends, AstraZeneca and GlaxoSmithKline will provide yields of roughly 6 and 5 per cent respectively, while British American Tobacco and Imperial Tobacco will provide dividend yields in the region of 4 per cent. We do like the way you have split up your exposure to the sector by investing in a couple of companies.

We consider the above stocks along with Tesco and Vodafone, which can in some ways be considered utility stocks, as your core holdings, generating high yields with defensive characteristics.

We agree that Lloyds could end up being one of your most lucrative investments, but this goes hand in hand with it being one of your more risky stocks. We are still uncomfortable with banking stocks as the macro environment is still uncertain with plenty of scope for some as yet unknown scandal to pop up again in the sector.

We would consider your 16 per cent exposure to homebuilding companies a little overweight; however, we understand the reasons for your bullishness towards the sector. The sector has been receiving boosts in the form of central banks' attempts to keep interest rates low to get the housing market going and acknowledgment by the government that we are short of roughly 100,000 homes in the UK. The sector will also benefit from infrastructure spending that has been touted to get the economy going. Spreading it out among several names is certainly a good way to play it.

Apart from the exposure to the housebuilders, we would say that the portfolio largely does match your attitude to risk. The majority of the portfolio is weighted towards the large-cap 'core holdings', proving the income and a degree of stability, with smaller holdings in riskier 'satellite' stocks providing stronger growth potential.

The portfolio as a whole has a yield of 3.4 per cent, slightly below that of the FTSE All-Share, and a beta of 0.96, meaning that your portfolio should be slightly less volatile than the market as whole.

Thursday, 11 October 2012

BAE Update

Okay, the EADS merger didn't go through so have bought back the sold shares (paid a penny more), and incurred some dealing costs. Bit of a waste of time and money in hindsight. Glad the merger fell apart though, as I believe this company will deliver on it's own, given time.

Tuesday, 9 October 2012

BAE Quandary

Yesterday I read an article on the BBC website concerning the proposed merger of EADS and BAE systems.

http://www.bbc.co.uk/news/business-19879916

As i have said in a previous post, I do not think the merger will be a good thing for shareholders. EADS is unattractively priced and it's dividend yield is miniscule in comparison to BAE.

The above article mentioned that Invesco Perpetual (BAE's largest shareholder, owning 13.3% of the company), along with many others are also unhappy with the deal.

If the merger goes ahead I'm sure that the resulting stock will be dumped by many funds and investors, especially those seeking dividend income. This could be very destructive to the share price.

For me this is no longer an investment, it's a gamble, and for that reason I'm out! I've sold my holdings for a price of 324p netting me a gain of 10% excluding any dividends i've received.

It's a bit of a shame as BAE is a great investment prospect as it stands, if the merger falls through I will probably look at buying back in if the price stays reasonable.

http://www.bbc.co.uk/news/business-19879916

As i have said in a previous post, I do not think the merger will be a good thing for shareholders. EADS is unattractively priced and it's dividend yield is miniscule in comparison to BAE.

The above article mentioned that Invesco Perpetual (BAE's largest shareholder, owning 13.3% of the company), along with many others are also unhappy with the deal.

If the merger goes ahead I'm sure that the resulting stock will be dumped by many funds and investors, especially those seeking dividend income. This could be very destructive to the share price.

For me this is no longer an investment, it's a gamble, and for that reason I'm out! I've sold my holdings for a price of 324p netting me a gain of 10% excluding any dividends i've received.

It's a bit of a shame as BAE is a great investment prospect as it stands, if the merger falls through I will probably look at buying back in if the price stays reasonable.

Friday, 21 September 2012

Managed Funds VS Index Trackers

Every year index tracker funds, on the whole, outperform their actively managed brethren. When you look at longer time frames this out performance becomes more pronounced as many active managers can get lucky in the short run, but are very unlikely to stay lucky for a 10+ year period.

'' A study by research firm WM Company found that 82% of managed funds failed to beat the market over the course of twenty years. While you may think that sounds bad, it's actually even worse, because this figure only includes funds survived for the whole twenty years -- many poorly performing funds are shut down or get merged into other funds.

This means that the chances of picking a fund now that will do worse than the market over the next twenty years is likely to be a lot higher than 82%, and is probably well in excess of 90%. '' - www.fool.co.uk

Index trackers cost less too. Most managed funds charge 3%-5% initial fee plus approximately 1.5% annually, while index funds generally have no initial fee and only cost around 0.5% annually. This is because index funds obviously have much lower labour costs to pass on and they generally trade much less than managed funds so incur less trading fees. These savings when compounded for many years can make a huge difference to the end result of an investment.

On the whole then, index tracker funds appear to be a fairly sensible place to stash your cash if you are looking for stock market exposure.

However!

There are a small minority of fund managers out there who have fantastic track records and have proved themselves well worth the extra fees incurred. Anthony Bolton to give one example, managed to return his investors on average 19.5% a year during his 28 year tenure at the Fidelity Special Situations fund (starting 1979). That would have turned a £10,000 investment into £1,470,000. The same £10,000 invested in a tracker over the same period would have got you only £346,644. (still not too shabby!!)

Managers of this calibre who can consistently beat the market over the long term are few and far between but it is well worth keeping your eye out for them. Mr Bolton is now managing the Fidelity Special Situations China fund, it's had a bit of a rocky start but after watching the video link below I gave him a bit of my money to look after.

https://www.fidelity.co.uk/investor/news-insights/expert-opinions/anthony-bolton/details.page?whereParameter=anthony_bolton/anthony-bolton-agm-2012

Where are your investments and pensions invested? Are they in index trackers or managed funds? If they are in managed funds then it could be well worth finding out who exactly is managing them and if they have proved themselves worthy of the extra fees involved.

Tuesday, 18 September 2012

September Market Update

Most Western markets have experienced a sustained rally during the last few months, the most recent leg being mostly attributed to Ben Bernanke's further monetary easing measures at the US FED.

On the face of it everything is looking quite rosy. My personal portfolio is hitting all time highs, thanks in part by some great recent gains in my house builders' shares. Persimmon have now almost doubled since I bought, and others such as Barrat, Redrow, Taylor Wimpey and Telford Homes are up between 25%-50%.

Also my Lloyds bank shareholding is doing quite well at the moment up about 30% to 40p from my average purchase price of 31p

My tobacco stocks, Imperial Tobacco and British American Tobacco, have fallen from grace a little after a great run, following a decision from the Australian government to ban advertising on cigarette packets. However I still see this pair as a great long term holding as they are positioning themselves to reap rich rewards from emerging markets and have a great track record for delivering returns to shareholders.

BAE systems, the weapons and technology company, is up about 20% from my purchase price of 285p on news of a potential merger with EADS, if the merger goes ahead I will re-evaluate and may well liquidise this holding as EADS dividend yield is much lower than BAE and their PE ratio is substantially higher. More research definitely needed here.

My big Pharmaceutical plays are treading water, a small loss showing on my AstraZeneca shares being offset by a small gain in GlaxoSmithKline. Both companies however throw off a good dividend of circa 5% and are attractively priced and should benefit long term from our ageing population so i will continue to hold.

My other holdings, BT, Vodaphone, Aviva, BG Group, Polo Resources and Tesco are all showing nominal gains (except Tesco which is down about 15%) and are generating decent dividend returns so will continue to hold these as well.

I must add that although I don’t plan to sell any holdings soon (except perhaps BAE) I am not wholly confident about the market's short/mid term prospects. As stated in previous posts I don't agree with the way Western governments are tackling their huge debt problems and I think we could see large fluctuations in market prices as the debt scenario plays out. I still believe however that good quality company shares are the best bet for the long term and will view any subsequent crashes/recessions as further buying opportunities.

Wednesday, 29 August 2012

Western Debt Junkies

In my last post, I talked about how the

It is somewhat disturbing that the chosen 'cure' for the Western debt problem is more debt.

The Bank of England base rate has been slashed to 0.5%, the

Lower interest rates = more incentive to get into debt = more debt = bigger problems down the road.

As well as incentivising debt, low interest rates also damage cash based investment returns. What is the point in having money in the bank earning 1.5% interest, when inflation is running at 3%? You are technically losing money. This doesn't just affect the rich, it affects everyone (who has a pension or savings). Pension funds need exposure to dependable cash based investments, low interest rates are damaging the returns on these investments leaving less money for people to retire on. Also annuity rates are linked in part to interest rates and as such are very low right now.

People retiring now who have been prudent and saved their whole lives are facing a double whammy of diminished pension pots and bad value from annuities. This will have a long term detrimental effect on the economy as their spending in retirement will be curtailed.

As our debts increase, our sensitivity to a rise in interest rates also increases, making it harder to return to a situation of normality.

I'm not suggesting a swift hike in rates as that could be very damaging. Rather a gradual elevation of about 0.5% a year.

The sooner we get ourselves off the faux life support system of cheap debt, the better our chances of a sustainable recovery.

Subscribe to:

Posts (Atom)