Another good link I found on Terry Smith's blog page.

The motivational speaker Tony Robbins ‘deconstructing’ the (debt) situation:

http://www.youtube.com/watch?v=jboTeS9Okak

(20 minute video)

Wednesday, 26 December 2012

Monday, 24 December 2012

Is Gold A Good Investment?

If you take a moment to scan the daily business pages, or perhaps flick your TV over to Bloomberg or CNBC, there is a good chance you will find some news about the price of gold. It is very much an en vogue investment at the moment; helped no doubt by it's incredible performance over the past 11 years or so as shown by the graph below.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

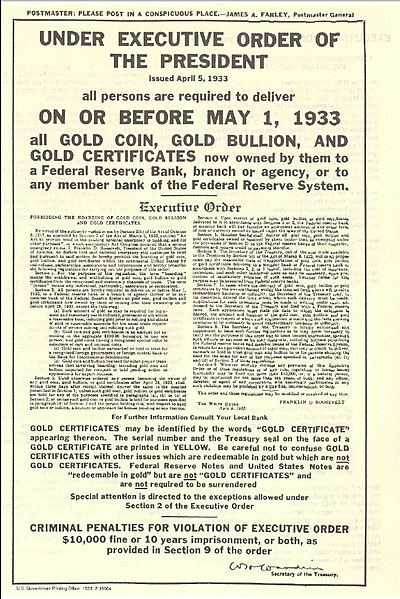

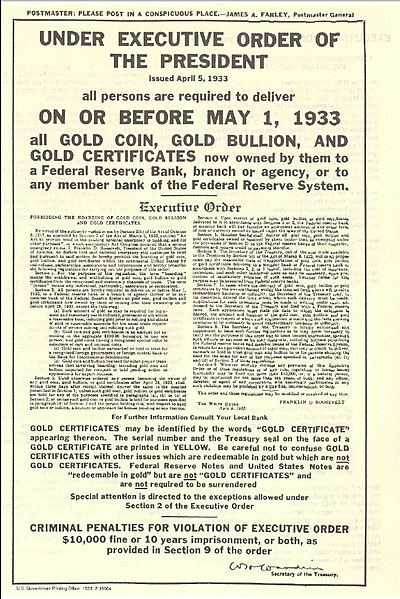

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Source: wikipedia.com

Gold has historically been viewed as a safe haven asset, a store of value that investors turn to when faced with economic uncertainty.

Gold prices tend to rise on a tide of fear. At the moment investors (me included) are fearful that Central Banks across the developed world are not addressing their debt problems sensibly. People are worried that our ultra loose monetary policy (low interest rates & QE) could lead us into a devastating bout of inflation such as experienced in Weimar Germany and more recently Zimbabwe or Argentina. This scenario might happen, and it might not, no one really knows for sure. The experiment that global central banks are trying has never been tried before, certainly not on this scale anyway.

Baring in mind the current backdrop of economic uncertainty, I'll revert back to the title of this blog: is gold a good investment?

There are four positive points I can think of.

1. It may serve as an insurance policy against economic catastrophe.

2. If things get worse economically, the price could rise further, possibly much further.

3. It could be used to hedge a portfolio, as the price should have some negative correlation with equities (not always the case).

4. A return to gold standard currencies would create big demand, potentially pushing prices much higher (highly unlikely).

Now here are the negatives.

1. Gold is a non productive asset. Therefore unlike a let property or a dividend yielding share of a company, you get no return for holding the asset. The only way you can make money on it is if the price rises. In the long run productive assets have outperformed gold by significant amounts.

2. It can cost a lot to store in any quantity, thus giving it a negative yield. Compounded over many years these costs would offset a proportion of any nominal price rise. You could call it a destructive asset in this sense.

3. It is already historically very expensive. Yes huge gains have been made over the past 10 years, but will this trend continue? Lots of gold ETFs (Exchange Traded Funds) have been set up which have to have a physical underpinning of the underlying asset. Such is demand for these products that recently banks have had to build more high security bunkers to keep all this gold in. Interestingly the UK has become a global hub for private storage of the world's gold. What if we manage to muddle through our economic problems and financial meltdown never materialises? Will people decide that paying good money to store their unproductive gold is possibly a bad idea and sell? There could be a massive rush for the proverbial exit from these highly liquid ETFs.

4. If people do start selling how low will the price fall? What is the intrinsic value of gold? Last time gold was relatively this expensive was in 1981, if you look at the graph above again you will see that 1981 was a pretty bad year to buy gold, if you bought then over the following 20 years you would have seen a gradual erosion of your investment.

5. How safe is an investment in gold anyway? During the great depression the US government brought in Executive Order 6102 which more or less banned the ownership of gold. The government ran a compulsory purchase programme, forcing people to sell at $20.67/troy ounce. The rationale was that the hoarding of gold was making the recession worse. Punishment for non conformity was a fine of $10,000 and up to 10 years imprisonment.

To conclude, I can see the reason why gold has become so popular. Investors are right to be scared about what's happening, and naturally are seeking to protect their wealth. There may be a valid case for allocating a part of your portfolio to gold. I however will not be doing this personally, as I think the negatives outweigh the positives far too much at it's current price point.

Wednesday, 5 December 2012

Hayek VS Keynes - Terry Smith Blog Post

This is a great blog post from Terry Smith's page, it pretty much sums up my views on the matter of Keynes VS Hayek (Austerity vs Spending).

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

http://www.terrysmithblog.com/straight-talking/2012/12/i-recently-read-this-excellent-article-by-john-phelan-a-contributing-editor-for-the-commentator-and-a-fellow-at-the-cobden.html

Why people prefer Keynesian policies

I recently read this excellent article by John Phelan, a Contributing Editor for The Commentator and a Fellow at the Cobden Centre, who draws some poignant comparisons between the economic theories of Keynes and Hayek. Phelan makes his point well by describing a debate which took place in the letters to The Times in October 1932 between John Maynard Keynes and Friedrich von Hayek.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

“A major difference between Hayek’s theory and Keynes’s is that for Hayek the bust as well as the boom is endogenous to the model…As Hayek’s model is radically different from Keynes’s, radically different prescriptions follow from it.”

"Hayek argued that as the bubble assets and attendant industries had been pumped up by unsustainable injections of inflationary credit, they could only be liquidated; any attempt to preserve their value would only prolong the bust or, as bad, set another cycle in motion. Sound money and non-intervention was the prescription of Hayek and his fellow Austrian Schoolers.”

“Looking back over the last few years you have to ask how intelligent people, examining the evidence, can still choose Keynes over Hayek. In both Britain and America we had monetary policy makers working to keep financing costs down with low interest rates. We had governments running budget deficits and applying fiscal stimulus to economies which were already growing. We followed the Keynesian prescription for prosperity and we still ended up with a bust – a bust which Hayekians, with their superior model, saw coming.

The answer lies in the prescriptions. Keynes, with his cheap credit and shower of borrowed money, is a pleasant prospect. Indeed, Paul Krugman, one of the most uncompromising modern Keynesians, believes that “Ending the depression should be incredibly easy”, all we need is cheaper credit and more borrowing. Just, in fact, what we had going into the crisis.

Hayek, on the other hand, offers a more painful prospect. As his mentor Ludwig von Mises put it:

Which of these vistas would you prefer to gaze upon?

But these theories should be judged not on how warm and fuzzy they make us feel but on how accurate they are. On that score Hayek wins hands down yet some still cling doggedly to Keynes. It’s for the same reason the aunt who gives you chocolates is preferred to the aunt who makes you do your homework.”

This week I wrote an article for the Daily Mail ahead of George Osborne’s Autumn Statement. I drew on some of the insights from my recent lunch with Jurgen Ligi the Estonian Minister of Finance who highlighted the dangers of trying to restore GDP growth to "the peak of the boom".

My article can be read here and below:

It's time to stop talking about growth

Asked to name just one thing that I think George Osborne should say in the Autumn Statement but he won’t, it is: ‘Stop talking about growth’.

We keep hearing about the lack of economic growth and this Autumn Statement will be no exception.

There will be hand wringing about lower growth than forecast, and Ed Balls will no doubt attack the Statement with his risible ‘Plan B’, which would equate to a doomed attempt to borrow and spend our way out of a debt crisis.

There may be gestures towards promoting growth in the form of a new business bank, increased infrastructure spend, and/or yet more misconceived nonsense about stimulating the housing market.

I had lunch recently with the Estonian Minister of Finance, Jürgen Ligi, and I think George Osborne should take his cue on what to say from him.

Mr Ligi was in London to put Estonia’s case after its economic record was criticised by the economist Paul Krugman.

Estonia experienced exceptional growth in 2000-07, but as the financial crisis took hold in 2008 it faced falling house prices and rising unemployment.

Estonia ran up a current account deficit which peaked at 18 per cent of GDP in 2007 and private sector debt which exceeded 100 per cent of GDP. Sounds familiar? GDP fell by 4.2 per cent in 2008 and by no less than 14.1 per cent in 2009.

Faced with this the Estonian government embarked on an austerity programme. A real one, not the sort of sham programme which the Chancellor has given us so far in which spending continues to rise but at a lower rate than originally forecast.

In Estonia public spending was cut by 10 per cent between 2008 and 2010. The state’s share of payments to pensions was frozen and its payments to health insurance costs were cut by 8 per cent. Taxes were also increased. In particular VAT was raised from 18 per cent to 20 per cent.As a result of these measures, Estonia’s deficit never exceeded 3 per cent of GDP. And the economy began to grow again (Mr Balls please take note) – by 3.3 per cent in 2010 and 8.3 per cent in 2011.

So what was Professor Krugman’s criticism of Estonia’s apparently exemplary record? It is that despite this recovery, GDP in 2011 was still some 8 per cent below its peak in 2007.

So when I met Jürgen Ligi, I asked him about this. He responded by saying that the GDP level at the peak of the boom was an illusion, and trying to get back to it was like the pursuit of a mirage.

The GDP at that point was inflated by excessive debt, as Estonians were borrowing more and more in order to sell each other more and more expensive houses. Sound familiar?

George Osborne should recognise that the UK is in a similar situation to that which faced Estonia, and around the world things are not getting any better.

The Eurozone economy is a train wreck which has at least diverted attention from the UK.

Japan, still the world’s third largest economy, has just entered its fifth recession since 1989. Its plight is a testament to the poor outcome of applying Keynesian economic theories, as its government debt is 20 times revenues.

It also suffers from the prolonged attempt after its property market crashed in 1989 to pretend that the over-leveraged borrowers were not bust and neither were the banks which lent to them. Sound familiar?

The US economy is stronger but it is worth remembering that austerity has yet to be even agreed much less implemented there – but it will have to be.

So I hope George Osborne says: ‘It is unrealistic to target significant growth, and a change of strategy to spend more would simply demonstrate the Law of Diminishing Returns’.

He should then spend his time dealing with the correction of the UK’s yawning budget and current account deficits. But I doubt he will.

Subscribe to:

Posts (Atom)