When the Labour party came into power in 1997, one of Gordon Brown's (then Chancellor) first moves was to hand over his interest rate setting powers to the Bank Of England's Monetary Policy Committee (MPC).

In one of said government's more laudable moves, it attempted to end the use of our interest rate as a political weapon. Messrs Brown and Blair announced that their new government heralded the end of boom and bust.

Unfortunately what we actually got was a little different, the biggest boom in recent history, followed by a spectacular bust that we are still reeling from today. It seems that the MPC, although politically impartial, is not infallible.

Residential property represents almost 50% of total personal wealth in the

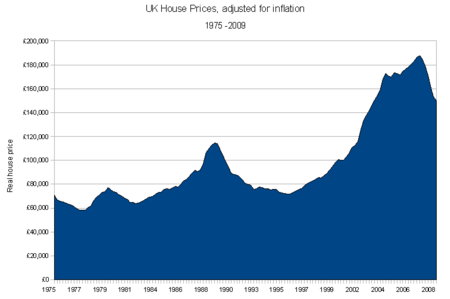

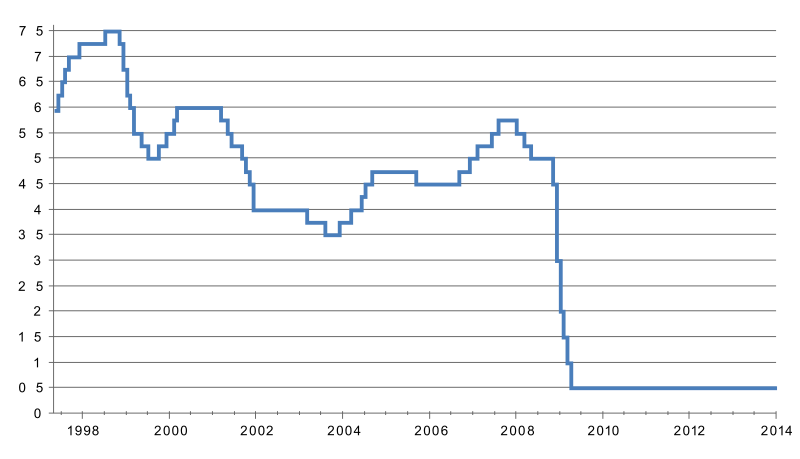

As we can see from the graph below, residential property prices started to spiral upwards around 2001/2002, yet at this time the MPC were actually cutting rates (as shown in the second graph). They really should have been putting rates up at this stage to stabilise house price growth, not incentivising people to borrow even more money.

UK Interest Rates - Source:Wikipedia

The MPC of course was chasing different targets. Headline inflation was low, and the economy had been growing consistently for quite some time. There was little question about where this growth was coming from (debt!!).

If interest rates had been raised earlier in the cycle, thus making debt more expensive, the housing market would have cooled. It's true that this may well have caused a recession in itself, but surely it is better to have much smaller more frequent recessions than huge busts that seem impossible to climb out of?

The trouble is that the members of the MPC are too scared of 'pruning' the economy. GDP growth figures can be very misleading and are a bad target to aim at, sometimes it is necessary to sacrifice short term growth for long term stability and prosperity.

Unfortunately the US Federal Reserve and the European Central Bank were both guilty of making the same mistake as us. Property prices throughout the Western world all rose on a tide of cheap debt, and have since come crashing back to reality bringing about a global slowdown and a myriad of associated problems.

If interest rates had been raised earlier in the cycle, thus making debt more expensive, the housing market would have cooled. It's true that this may well have caused a recession in itself, but surely it is better to have much smaller more frequent recessions than huge busts that seem impossible to climb out of?

The trouble is that the members of the MPC are too scared of 'pruning' the economy. GDP growth figures can be very misleading and are a bad target to aim at, sometimes it is necessary to sacrifice short term growth for long term stability and prosperity.

Unfortunately the US Federal Reserve and the European Central Bank were both guilty of making the same mistake as us. Property prices throughout the Western world all rose on a tide of cheap debt, and have since come crashing back to reality bringing about a global slowdown and a myriad of associated problems.

I have been checking out a few of your stories and i can state pretty good stuff. I will definitely bookmark your blog estate agent Dagenham

ReplyDeleteObviously, you will be stressed heavily when you build your home. On the other hand, when you buy a residential home, you can avoid getting stressed. You do not have to worry about things such as power backup, maintenance and security when buying a residential flat.Katy Property Management

ReplyDeleteConstruction estimating software will enable you to keep track of every expense, every day and produce analysis and reports on demand, without getting out your calculator. construction contractors santa clarita

ReplyDeleteREAL ESTATE synonymous with real property" and p.1218 REAL PROPERTY ... A general term for lands, apartments, hereditaments (those things which are genetic); which on the demise of the proprietor intestate, goes to his beneficiary. the opus condo

ReplyDeleteWhen a blind man bears the standard pity those who follow…. Where ignorance is bliss ‘tis folly to be wise…. Low VOC's

ReplyDeleteGreat post.. glad i came across this

ReplyDeletelooking forward to share this with everyone here

Thanks for sharing picbear